Recession Could Impact Orange County’s Housing Market

How a Recession Could Impact Orange County’s Housing Market

Introduction

Orange County, California is known for its high home prices and competitive real estate market. With economists increasingly discussing the possibility of a recession, many homebuyers and investors are wondering how an economic downturn could affect Orange County’s housing scene. Will home prices plunge as they did in 2008? Could a recession finally ease the inventory crunch or will sellers hold back? In this blog post, we’ll explore data-driven insights on how a recession might impact home prices, inventory levels, mortgage rates, and buyer demand in Orange County. We’ll also compare potential outcomes to the 2008 housing crash and other past recessions to put things in historical context. The goal is to give both prospective buyers and real estate investors a clearer picture of what to expect – backed by trends and facts, not just speculation.

Orange County Housing Market Today: A High-Price, Low-Inventory Environment

Before diving into recession scenarios, let’s set the stage with the current Orange County market. As of early 2025, home prices in Orange County remain near record highs. The median sale price is around $1.2 million, up roughly 9% from the year prior.

This growth comes even after a year of rising interest rates, indicating that demand, while cooled, is still outpacing supply. In fact, inventory (the number of homes for sale) is extremely tight by historical standards. The year 2024 began with only about 1,600 homes on the market – one of the lowest levels in decades – and even at its seasonal peak in late 2024, inventory was about 3,700 homes, roughly half the pre-pandemic norm of ~7,000 listings. Many homeowners are “hunkering down” in their current houses, unwilling to sell since they refinanced into low mortgage rates in recent years. New listings in 2024 were 41% fewer than the typical volume before 2020.

Meanwhile, buyers face mortgage rates around 6.5–7% (as of early 2025), which has dampened affordability and tempered some of the buying frenzy. In short, Orange County’s market entering a potential recession is characterized by high prices, limited supply, and moderating (but still present) demand. This context will influence how a recession might play out differently than past downturns.

Home Prices in a Recession: Likely a Slowdown, Not a Freefall

One of the biggest questions is what happens to home prices if a recession hits. It’s important to note that not all recessions result in falling home prices. Historically, U.S. home values have often held steady or even increased during recessions. In fact, during the brief early 1990s recession, national home prices dipped less than 1% and during the early 2000s dot-com recession, home prices actually climbed as low interest rates spurred demand. Even in the double-dip recessions of the early 1980s, home prices in the U.S. managed to rise modestly (e.g. +4.5% in 1980) despite sky-high interest rates.

The major exception was 2008’s Great Recession, which was triggered by a housing market collapse. During that crisis, home values plummeted – nationally, prices fell around 20–30%, and Orange County was hit even harder. From late 2007 to late 2008, the median home price in Orange County plunged by roughly 30% (dropping to about $397,000 by December 2008).

This kind of severe price crash was unprecedented and was driven by a perfect storm of overinflated prices, subprime lending, and a wave of foreclosures.

If a recession were to occur in the near future, most experts do not foresee a 2008-level price collapse in Orange County, barring some new crisis specific to housing. Today’s market doesn’t have the same red flags: lending standards are tighter, speculative buying is lower, and there’s no glut of new construction. Additionally, many owners have substantial equity cushions. Therefore, a recession would more likely cause home price appreciation to stall or turn modestly negative rather than an outright crash. We might see prices flatten or dip slightly for a period as buyers become more cautious and some urgent sellers price their homes more competitively.

This would be a stark contrast to 2008 when values were in freefall. It’s worth noting that even during the Great Recession, once prices fell to a more affordable level, buyer activity resumed and helped put a floor under the market. By 2009, bargain hunters and investors had stepped in, and Orange County home sales surged as lower prices attracted demand (the county saw a 79% jump in sales in early 2009 versus the prior year, in tandem with prices being about one-third lower)

In a future recession, any price corrections could similarly set the stage for a quicker stabilization, especially given Orange County’s underlying desirability and limited land for new development.

Crucially, local market dynamics will matter. Orange County’s supply constraints may cushion prices to some degree – if few people list their homes, values won’t freefall even if demand softens. We saw a hint of this resilience during the brief pandemic recession in spring 2020: after a momentary pause, home prices accelerated upward later in 2020 as ultra-low mortgage rates and scarce inventory fueled competition (very unlike 2008’s trajectory). While we can’t bank on a repeat of the unusual COVID housing boom, it illustrates that house prices don’t automatically collapse just because GDP shrinks. In summary, Orange County home prices in a recession would likely experience a pullback or plateau, particularly at the high end, but a catastrophic drop akin to 2008 is considered unlikely by most analysts given today’s market fundamentals.

Inventory Levels: Will a Recession Increase Housing Supply?

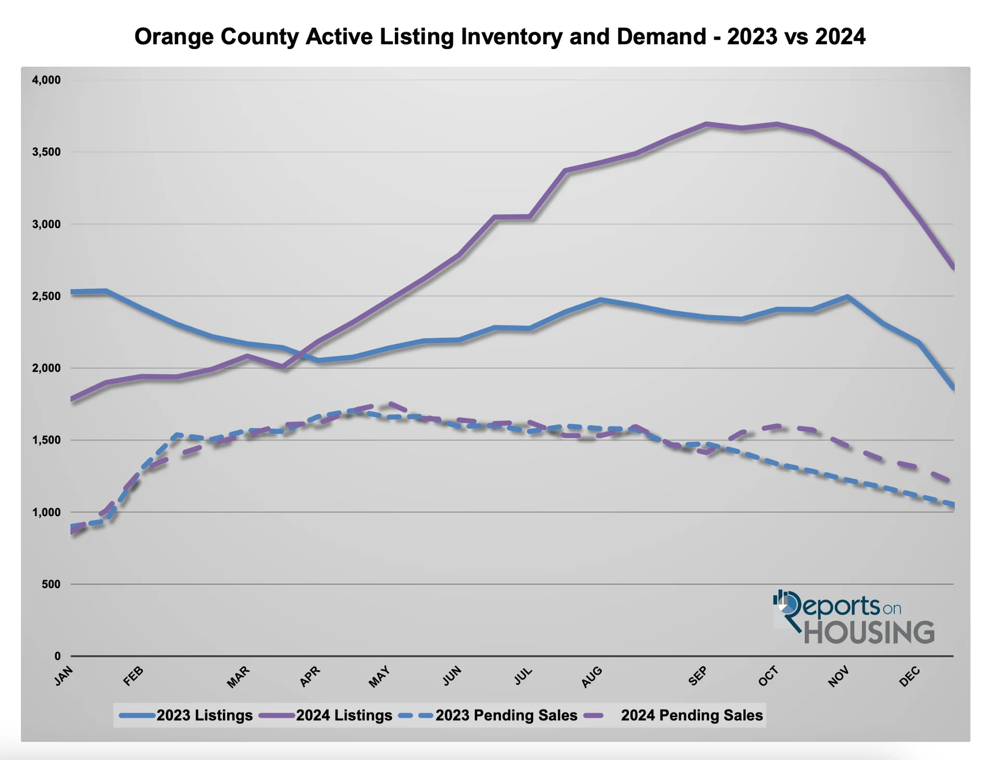

Figure: Orange County active listings (solid lines) and pending sales (dashed lines) for 2023 (blue) vs 2024 (purple). Inventory in 2024 (purple solid line) peaked higher than in 2023, yet remained well below historical norms, while buyer demand (purple dashed line) stayed relatively subdued. Even as listings increased in 2024, the supply of homes was far lower than pre-2019 levels, highlighting a persistent shortage. A recession could shift these dynamics – possibly leading to more homes on the market if some owners are forced to sell – but a huge glut like 2008’s is less likely given the current starting point of limited inventory.

Another key factor is housing inventory – essentially, the supply of homes available for sale. In a balanced market, Orange County might have around five to six months of inventory (meaning at the current sales pace, it would take ~5–6 months to sell all listed homes). In recent years, however, inventory has been well below that level, often under 3 months’ supply, which signifies a strong seller’s market. During a recession, inventory can move in different ways. On one hand, buyer demand typically declines, which means homes take longer to sell and listings can accumulate – pushing inventory up. On the other hand, if prices soften, some sellers may hesitate to list (why sell at a low point if you can wait?), which can reduce the influx of new listings. The net effect on inventory will depend on how desperate or forced sellers become.

Looking back at 2008 again: Orange County experienced a massive spike in inventory as the market unraveled. Homes flooded the market due to foreclosures and short sales, and buyers were scarce. By late 2007, Orange County had a staggering 29 months’ supply of homes – an enormous overhang of inventory – and even early in 2008 the supply was still over 20 months.

(For comparison, a normal market might be ~6 months, so 20+ months was off the charts.) That oversupply put intense downward pressure on prices. Eventually, as prices dropped and investors swooped in, the inventory started to clear. But the lesson from 2008 is that when many homeowners are forced to sell at once (or banks unload foreclosures), inventory can explode and exacerbate a downturn.

Today, we are in a very different position. Inventory is near historic lows, not highs, as we head toward a possible recession. As noted earlier, Orange County’s active listings in 2024 peaked around 3,700, which is half or less of the inventory available during pre-2008 times.

This low baseline means even if inventory rises, it might go from “insanely tight” to just “somewhat tight.” A recession could prompt inventory to increase moderately: for example, some homeowners who lose jobs or face financial stress might need to put their homes up for sale. We might also see fewer bidding wars, so listings don’t get snapped up as quickly, allowing the number of homes on market to build up a bit. Buyers in a recessionary period could finally have a wider selection to choose from than in the recent past.

However, it’s unlikely we’d see anything like the glut of 2007-2008 unless the recession is coupled with a housing-specific crisis. Why? Firstly, we aren’t overbuilt – homebuilders have been relatively cautious, and there isn’t a huge surplus of new homes sitting vacant. Secondly, the “hunker down” effect is strong: most homeowners today have 30-year fixed mortgages often with ultra-low rates from refinancing in 2020-2021, so they’re not eager to sell and give up those rates.

In a mild recession, many would rather ride it out than sell at a discount. Also, unlike 2008, very few are underwater on their mortgages – in fact, the average homeowner with a mortgage has over 50% equity nationally, and likely similar in Orange County after a decade of price gains. This means fewer foreclosures; people have a cushion to refinance or negotiate rather than default. A recent local housing report noted that distressed sales (foreclosures and short sales) remain minimal in Orange County thanks to a “healthy housing stock” and equity-rich owners.

All told, we can expect some increase in inventory in a recession as the market cools, which could gradually shift Orange County toward a more balanced market. Buyers may see more choice and a bit more negotiating power than the ultra-tight conditions of late. But unless the recession is very deep, inventory likely won’t reach levels that tip the market completely in favor of buyers (for example, a 12-month or greater supply would be a real buyer’s market, and that seems unlikely short of a 2008-scale event). In fact, one Orange County forecast scenario suggests inventory might peak around 4,000–5,000 homes in 2025 if the economy slows – higher than now, but still below long-term averages.

A truly “flooded” market appears to be a low-probability outcome given current conditions. This is cautiously good news for existing homeowners and helps explain why we don’t anticipate a freefall in prices.

Mortgage Rates and Financing Costs: Potential Relief Ahead

If a recession hits, mortgage rates will be a wildcard – but history provides some clues. Generally, during economic downturns the Federal Reserve moves to cut interest rates in order to stimulate growth. We saw this in the 2008 recession, when the Fed slashed its benchmark rate to near 0%, and 30-year fixed mortgage rates fell from over 6% in 2007 to around 4–5% by 2009-2010

During the brief 2020 COVID recession, the Fed also intervened aggressively, and mortgage rates plummeted to historic lows under 3%

Lower interest rates reduce borrowing costs, which can boost home affordability – one reason the housing market often stabilizes or even improves toward the end of recessions.

However, the relationship between recessions and mortgage rates isn’t always so straightforward. One important factor is inflation. In typical recessions with low inflation (like 2008 or 2001), the Fed has lots of room to cut rates and keep them low. But if a new recession comes while inflation is still somewhat elevated, the Fed might be more hesitant. As of 2025, inflation has cooled from its 2022 highs but is not necessarily back to the Fed’s 2% target yet. Fed officials have signaled caution, balancing the risk of economic slowdown against still-above-target inflation

This means that while a recession would likely lead to interest rate cuts, we might not see mortgage rates drop as dramatically or as quickly as they did in 2008 or 2020 if inflation is a concern. For example, if inflation were, say, 3–4%, the Fed might only gently nudge rates down, resulting in mortgage rates that maybe fall into the 5-6% range rather than plunging below 4%.

That said, many market watchers do anticipate some relief in mortgage rates in a 2025 recession scenario. Futures markets and economists have been predicting at least a few Fed rate cuts in 2025 which could trickle down to mortgage rates. Some forecasts suggest mortgage rates could dip into the mid-5% range if the economy contracts, which would be a noticeable improvement from ~7% levels. Lower rates could be a silver lining for homebuyers and even current homeowners. Buyers who were priced out by high monthly payments might re-enter the market if rates fall, supporting demand. Current owners might get a chance to refinance to reduce their payments, or consider trading up if they can port or obtain a new mortgage at a lower rate. Real estate investors, too, would benefit from cheaper financing for purchases.

It’s also worth noting that in past recessions the mortgage market tightened lending standards, which can offset the benefit of lower rates. Lenders may become more risk-averse about who they approve loans for when the economy is shaky. So while rates might be lower, buyers will still need solid credit and income stability to take advantage of them. In 2008, for instance, credit froze up for a while – but today’s lending standards are already tighter, so we don’t expect a credit crunch so much as a gradual easing of rates.

In summary, if a recession arrives, expect mortgage rates to trend downward, providing some relief on the cost of borrowing. Historically, this is one of the mechanisms that helps the housing market eventually recover during a downturn

The big question will be how much and how fast rates fall. A significant drop in rates could even stimulate housing demand enough to put a floor under home prices (some experts argue that a mild recession which brings rates down could actually boost housing activity by late 2025)

Conversely, if the Fed treads carefully and rates only inch down, the housing market might see only a minor uptick in affordability. For planning purposes, buyers and investors might want to watch Fed policy closely – the timing of rate changes could create windows of opportunity (for example, a short period where both home prices have softened and rates have fallen, creating a more favorable buying environment). Being ready to act during that window could be advantageous.

Buyer Demand and Investor Behavior: Cautious Buyers, Opportunistic Investors

A recession inevitably affects buyer demand in the housing market, as well as the strategies of real estate investors. In Orange County, where homes are expensive, buyer demand is closely tied to job market health and consumer confidence. During a recession, we can expect many would-be buyers to turn cautious. Job losses or fear of unemployment make people think twice about major purchases like a house. Even those whose jobs are secure may hold off, anticipating that prices or interest rates could fall further.

This tends to reduce the number of active buyers in the market. We saw a dramatic example of collapsed demand in late 2007 and early 2008: home sales volume in Orange County fell sharply as the Great Recession began and credit markets froze. According to the California Association of Realtors, the number of home sales in Orange County dropped by over 50% from the mid-2000s boom to the trough of the recession.

Fewer buyers were competing, which in turn caused listings to sit longer and motivated sellers to cut prices.

However, demand doesn’t vanish entirely – especially in a place like Orange County where there’s always a baseline need for housing (people get married, have kids, move for jobs, etc., recession or not). In fact, even in the depths of the 2008-09 recession, over 4 million homes were sold nationally in 2008 indicating that transactions continue to happen. What changes is the character of buyers in the market. In downturns, we often see fewer first-time buyers and “move-up” buyers, but potentially more investors and bargain hunters stepping in. Savvy real estate investors often view recessions as a time of opportunity: property prices may be more negotiable, and there is less competition from ordinary homebuyers. After the 2008 crash, for instance, institutional investors and house flippers purchased many distressed properties at low prices, renting them out or waiting for values to recover. We could see a smaller-scale version of that in a future recession – e.g. local investors looking for deals on condos or single-family homes if prices dip 5-10%.

For the average homebuyer, a recessionary market can actually be less stressful in some ways. Over the past few years, Orange County buyers have dealt with intense bidding wars, having to make quick decisions and often pay over asking price. That environment might change. Buyer competition would likely ease. Homes could take longer to sell, meaning buyers have a bit more breathing room to shop around. Already by late 2023, Orange County homes were taking around 36 days to sell versus 32 days a year earlier and in a recession that could extend further. We might return to a scenario where sellers are willing to negotiate on price or contingencies, whereas in the recent hot market many buyers had to waive contingencies to win a home. If inventory rises as expected, buyers will have more choices and won’t all be chasing the same few listings. In short, the balance of power shifts slightly toward buyers compared to the ultra-seller’s market of 2021-2022.

That being said, buyers will need confidence in their personal finances before jumping in. Lenders will still require solid income and credit, and some buyers may not qualify if their employment becomes unstable. Those who do feel secure – for example, someone with a stable job who has been sitting on the sidelines – might view a recession as the chance to finally buy without as much competition. Pent-up demand can build during a recession, then release once the outlook improves. We saw this cycle in the early 1990s in Southern California: sales slowed in the recession of 1990-91, but by the mid-90s the economy recovered and housing demand picked right back up (with Orange County home prices rebounding in the latter half of the decade after stagnating for a few years)

On the investor side, Orange County’s high prices mean rental yields are relatively low, but investors often bet on long-term appreciation. In a recession, rents can be a mixed bag – some renters may consolidate households or leave the area if jobs dry up, which can soften rent prices. However, typically when buying becomes harder (due to credit or fear), more people remain renters, which can bolster rental demand. For example, after 2008 many displaced former homeowners became renters, creating a strong rental market in subsequent years. So investors will be weighing these factors. Those with cash or good financing will look out for foreclosure deals or sellers who need to offload property quickly. We likely won’t see a huge wave of foreclosures in Orange County unless unemployment skyrockets, but even a modest uptick in distress could present opportunities for investors that haven’t existed in recent years.

In summary, buyer demand will probably pull back in the face of a recession, especially among typical homebuyers, but it won’t disappear. The composition of buyers may tilt more toward investors or those less affected by the downturn. Home sellers, in turn, will have to adjust to this new reality – homes might not “sell themselves” in a week with multiple offers like in the 2021 frenzy. Marketing, pricing competitively, and perhaps offering incentives (help with closing costs, etc.) could become more common to entice the fewer buyers that are active. For buyers who do feel ready and able, a recessionary market in Orange County could be an opportune time to purchase with less competition and potentially friendlier prices, as long as they think long-term. For investors, it could be the moment to pick up properties that finally cash flow or that have greater upside when the economy improves.

Why This Downturn May Differ from 2008

It’s worth explicitly comparing today’s situation vs. the 2008 crash, because that comparison is on everyone’s mind when we talk about recessions and housing. The Great Recession has become a mental model for worst-case scenarios: home values plummeting, foreclosure signs on every block, and years of recovery. Fortunately, a future recession is likely to look very different for Orange County real estate. Here’s why:

- No Housing Bubble This Time (Relative to Fundamentals): In 2008, home prices had run far ahead of incomes and rents – we were in a classic bubble. Mortgages were handed out to people with no income documentation, and many buyers speculated on ever-rising prices. Today, while home prices are indeed very high, the lending behind those prices is solid (buyers are required to document income, make down payments, and have good credit). There isn’t a huge pool of “risky” mortgages waiting to default. So we don’t have a bubble that’s poised to burst in the same way. Any correction in prices is likely to be more gentle absent that bubble psychology.

- Homeowner Equity and Credit Quality: When the 2008 downturn hit, a lot of homeowners had zero or negative equity (owing more than the house was worth) because they bought with tiny down payments or did cash-out refinances at the peak. That meant they had little skin in the game and often chose to walk away when values fell, leading to foreclosures that further pushed down prices. Now, after a decade of rising prices, plus more conservative mortgage practices, the typical homeowner has a substantial equity buffer. As noted, Orange County’s median prices have roughly doubled from 2010 to 2020 so anyone who bought years ago is sitting on gains, and even recent buyers mostly had to put 10-20% down. This equity cushion makes a huge difference – even if prices dipped, say, 10%, the vast majority of owners would still be above water. Thus, we shouldn’t see the same cascade of foreclosures. Mortgage delinquency rates in late 2024 were near record lows thanks to strong underwriting in the past decade.

- Inventory is Restrained, Not Excessive: As discussed, 2008 had an oversupply problem – homebuilders had constructed massive amounts of new housing, and when demand evaporated there was a glut. Orange County in the mid-2000s had new condos and subdivisions that suddenly had no buyers. Right now, if anything, we have undersupply. Builders are still playing catch-up from the pause during COVID and prior slowdowns, and zoning in Orange County is relatively restrictive. There isn’t a big pipeline of vacant new homes; in fact, any new units are often pre-sold or absorbed quickly due to pent-up demand. This lack of oversupply means we’re less likely to see a steep dive in prices. In economic terms, the floor under prices is higher because there’s a real shortage of housing. Even in a recession, people need a place to live, and Southern California’s population and desirability provide underlying demand.

- Different Economic Trigger: The cause of a recession matters for housing. In 2008, housing itself was the trigger (the subprime mortgage meltdown). In a future recession, the cause might be, for example, the Federal Reserve’s interest rate hikes slowing the economy, or a global shock, etc. If housing isn’t the core problem, then housing might actually hold up better than other sectors. We saw this in 2001’s recession – it was caused by a stock market crash and 9/11; housing was not overvalued then, so home prices in Orange County kept rising through that mild recession. If the next recession is more of a traditional business cycle downturn (and not a housing crisis), Orange County’s home market may prove resilient, with only minor adjustments.

None of this is to say Orange County is immune to a recession – only that a 2008-style implosion appears unlikely given current conditions. Recessions can certainly slow price growth, increase days on market, and lead to some price declines especially in higher-priced segments or less desirable locations. But a scenario where Orange County’s median home price drops 30-40% as it did from 2007 to 2009 would probably require a perfect storm of events far worse than what analysts now foresee. In fact, the California Association of Realtors is forecasting flat to modestly higher home prices in 2025 for the state, on the assumption that any recession would be relatively mild and inventory will remain constrained.

The bottom line is that 2025’s housing market challenges will likely be different in scale and nature from 2008’s, with more of a soft landing if possible rather than a crash.

Bottom Line for Homebuyers and Investors

Whether you’re a first-time homebuyer, a move-up buyer, or a real estate investor, it’s crucial to stay level-headed during a recession and focus on data and long-term strategy rather than headlines. Here are a few takeaways and tips based on the trends we’ve discussed:

- Opportunities for Buyers: A recession could open a window of opportunity for patient homebuyers. If you’ve been outbid or priced out in recent years, a slower market with fewer competing buyers might be your chance to negotiate a purchase on more favorable terms. You might not have to offer tens of thousands above asking price, and sellers may be more willing to accommodate contingencies for inspection or appraisal. Additionally, keep an eye on mortgage rates – you could potentially lock in a rate dip if the Fed cuts rates (historically, mortgage costs come down in recessions). Combining a slightly lower home price with a lower interest rate can significantly improve the affordability of an Orange County home, which is great news for buyers. The key is to make sure your personal finances are stable; buying during a recession is only wise if your income is secure enough to handle potential ups and downs. Don’t try to perfectly “time the bottom” of the market – even experts only know it in hindsight. Instead, look for a home that meets your needs at a price and payment you can comfortably handle, and remember that Orange County real estate tends to reward long-term holders. Even those who bought just after the 2008 crash, during the scariest times, saw significant gains over the following decade

- Considerations for Sellers: If you’re a homeowner thinking of selling, a recessionary environment means you may need to adjust expectations. Your home might not fetch the sky-high price your neighbor got last year, and it could take longer to sell. Pricing realistically and making your property stand out (through staging, necessary fixes, etc.) becomes more important. However, note that Orange County’s low inventory will still work in your favor – you won’t be facing a flooded market unless the downturn is very severe. If you don’t need to sell, you might choose to wait things out. But if you do sell, rest assured that there are always buyers for well-priced, well-maintained homes, even in a slower economy. People still get job transfers, families still grow – life events don’t pause for recessions.

- Investor Outlook: Real estate investors should prepare for a shift in strategy. The go-go price appreciation of the past few years might cool, so short-term flips could be riskier unless bought at a significant discount. Instead, investors might focus on buy-and-hold opportunities, taking advantage of any price dips to acquire property in high-demand areas of Orange County at a relative bargain. With rental demand likely to stay solid (as some families opt to rent longer if buying is tough), the rental market could provide steady income. If you’re investing, ensure you have cash reserves – both to seize opportunities (e.g. buying a distressed property quickly) and to cover any vacancies or repairs, since economic turbulence can affect rental turnover. Also, watch the lending environment; if traditional loans become harder to get, be ready to explore alternative financing or partnerships. Historically, those who invested during downturns often reaped rewards later. Buying when sentiment is bearish can be smart as long as you choose properties with sound fundamentals (good location, quality construction, realistic cash flow projections).

- Keep an Eye on Data: In a fast-changing economic climate, make data your friend. Track Orange County housing indicators like inventory levels, median prices, and days on market, which are often reported by sources like the California Association of Realtors or local real estate boards. For instance, if you see inventory starting to climb and months of supply moving from, say, 3 months to 6 months, you’ll know the market is tilting toward buyers and you might negotiate more aggressively. Conversely, if the Fed slashes rates and suddenly open house traffic picks up, that might mean a short-lived buyer’s market could tighten up again. By staying informed with up-to-date stats and reputable forecasts, you can make more objective decisions rather than reacting emotionally to news

- .

Conclusion

While the word “recession” may sound alarming, it’s not a death sentence for the housing market – especially not in a place like Orange County, which has enduring demand drivers. A recession would certainly test the market’s strength: we’d likely see slower sales, a bit of an uptick in inventory, and maybe some plateauing or modest declines in prices for a period. Homeowners might feel less paper-rich than before, and agents will have to work harder to close deals. Yet the data and historical trends suggest that Orange County real estate should weather a recession better than it did in 2008, thanks to today’s lower supply and healthier loan practices. In many ways, a cooling off would bring a healthier balance between buyers and sellers, after several years of frenzy.

For homebuyers and investors with a long-term perspective, a recession can actually present opportunities – the chance to buy in a great location at a slightly better price or interest rate, for example. The key is to remain level-headed and informed. Use the lessons of past downturns (like the fact that housing recovered and even thrived after recessions such as 1982, 1991, and 2008) to contextualize what’s happening

Real estate is inherently cyclical, and recessions are a part of that cycle. By understanding how factors like home prices, inventory, mortgage rates, and buyer demand interact during economic slumps, you can make savvy decisions rather than fearful ones.

In the end, Orange County’s housing market has shown it can rebound from tough times – it has done so after every prior recession. Those who navigate the next one with data-driven insight and patience may find themselves in an advantageous position when the economy eventually swings back upward. Whether you’re looking to buy your family’s forever home or expand your investment portfolio, keep a close eye on the trends and remember that in real estate, fortune often favors the well-informed and the patient. By staying prepared and adaptable, you can turn the challenges of a recession into opportunities in the Orange County real estate market.